Proper Storage and Mooring, and Its Impact on Your Boat Insurance

Marine insurance, like other insurance policies, is greatly influenced by risk factors. Among these major risk factors are storage and mooring practices, both of which

For Business or Pleasure, HUB Has You Covered

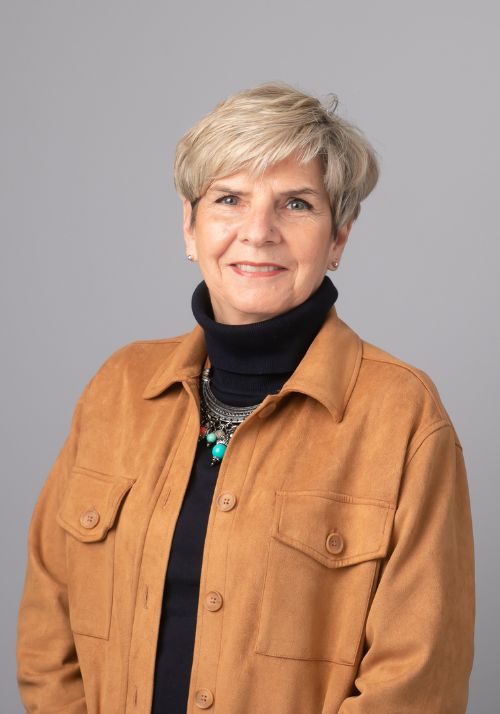

Beverly Carlson

Senior Account Manager

Michaela Kuehn

Senior Account Manager

Killian Heraughty

Account Executive

Michael McCray

Insurance Advisor

WHY HUB?

With multiple underwriters, HUB will find you the best value insurance to save you money, while protecting your investment.

We offer a variety of service levels, providing you with choice to select right insurance for your marine needs.

HUB is here to assist you with your emergencies, at any time, with a 24/7 claims number.

Our team has well over 50 years of industry experience and can provide you with the seamless service you deserve.

HUB can provide excellent coverage for your float home.

HUB has partnered with the right Underwriters to provide you with the coverage you need for you to live aboard, with the knowledge that your boat and contents are protected.

Finding coverage for your older boat can be tricky, but you can rely on HUB’s expert team to find you the protection you need.

HUB International provides coverage for your car, house and business, so you can keep all your risk management under one roof.

See What Our Customers Are Saying

Frequently Asked Questions

Most marinas will require you to carry at least $1 Million in Liability Insurance. However, to be properly protected within the scope of the Marine Liability Act, you need to carry a minimum of $2 Million in coverage.

Depending on the age of your vessel, you may be required to have a Marine Survey done. The surveyor will need to be approved by Underwriters or a member of SAMS (Society of Accredited Marine Surveyors) or NAMS (National Accredited Marine Surveyors).

Wood vessels are more expensive to insure than fibreglass vessels.

Most claims happen outside of office hours. Does your broker have 24 hour claim service? Do they have the actual knowledge to assist you with appointing a Surveyor, Lawyer, Salvage Team and other experts you may need on the weekend?

Not all insurance policies are the same. It is not always about price, but what you get for that price. Two aspects you want to look at closely when shopping around are: the exclusions of the policy and how a loss is settled. At HUB International, our Lifeline policy is an agreed value policy. That means we will not depreciate your vessel in the event of a total loss. All partial loss claims are settled on a new for old basis, again meaning no depreciation (not even on Sails, Canvas, Upholstery, or Rigging). Our Lifeline policies have fewer exclusions than most other policies.

The limit of insurance you purchase on your boat needs to include items such as taxes, duty, freight and additional equipment installed. Those values may not be included in the initial price of your boat. The limit also needs to reflect the furnishing and equipment, which would include kitchen items, safety gear, bedding, and anything else that is part of the running or operation of your vessel.

There is a difference between resulting damage due to Latent Defect and wear and tear. Our policies cover both. Many other policies available will only cover Latent Defect. Latent defects are inherent weaknesses which normally are not detected by examination or routine tests, but which were present at the time of manufacture and are aggravated by use. Our policy will cover resulting damage when the damage results from faulty designs, faulty workmanship, the installation or use of improper or defective materials, wear and tear, gradual deterioration or corrosion provided the defect or condition would not have been detected through a reasonable prior inspection.

The difference between Replacement Cost, Agreed Value and Actual Cash Value. Do you REALLY know what you are insured for? Replacement Cost: In the event of a total loss, your Underwriters would replace the boat with a similar current model year, despite the limits shown on the policy. In the event of Partial Loss, repairs will be done a new for old basis without deduction. Agreed Value: In the event of a total loss, you would be pay out what you are insured for on your policy coverage page with no deduction for depreciation. In the event of Partial Loss, repairs will be done a new for old basis without deduction. Depreciated Value: Applying full depreciation to your vessel may result in you not being paid out the full amount you are insured for. Partial losses would also be depreciated on all parts and labour.

The misconception is that if you own or operate a marina, you automatically require Marina Operators Liability. Yet this is not true in all cases. Step one is to identify your risk exposure. If your Marina offers any of the following, you do indeed require Marina Operators Liability:

The answer is an important follow-up question: Do you have Care, Custody & Control of your customers’ vessels?

If you have Care, Custody & Control of a client’s vessel and you are being paid for your Marina services, you are acting as a Bailee for Reward. That makes you legally liable for any damage to the vessel resulting from your negligence. If vessels are left with you—whether in your yard, building, ways or travel lift—you again have Care, Custody and Control. The same applies if you provide pick up and/or deliver your client’s vessel.

No Matter Where You Are, HUB Has You Covered

Latest Marine Insurance Industry News

Marine insurance, like other insurance policies, is greatly influenced by risk factors. Among these major risk factors are storage and mooring practices, both of which

Nobody wants to fall victim to a fire. It is, at very least, a terrifying experience, so prevention is key, as well as ensuring your

Owning a boat is an incredible experience, infusing leisure time with a sense of freedomand adventure. However, keeping a boat in tip-top shape requires diligent

Whether it’s for leisurely afternoons fishing on serene lakes or thrilling water sports activities on the ocean, owning a boat in British Columbia offers limitless

Understanding Boat Insurance Coverages for Environmental Incidents Liability coverage in boat insurance includes bodily injury and property damage coverage, safeguarding you if you’re responsible for

The thrill of cruising on the open water, whether on a leisurely fishing trip or a lively party cruise, is an indisputable aspect of boating.

400-4350 Still Creek Drive

Burnaby, BC V5C 0G5

Personal: +1 (604) 229-6547

Business: +1 (236) 877-2400

Claims: 1-855-HUB-HELP

Mon to Fri: 8 am to 5 pm

Claim Service: 24 Hours

Manage All Your Risk Under One Umbrella